“A clearing in the clouds” pattern

Candlestick patterns are good helpers in trading. If you can read them, then you can easily predict where the price will go. You can add a couple of indicators to the chart to verify the correctness of the tips you get from candlestick patterns, just as we did in this strategy. As a result, the number of profitable trades you have will be noticeably higher!

Configure the template

- The recommended timeframe is from 15s to 1m;

- Moving Average (MA) with a period of 5 and type Exponential;

- RSI with a period of 8 and levels of 70 and 30.

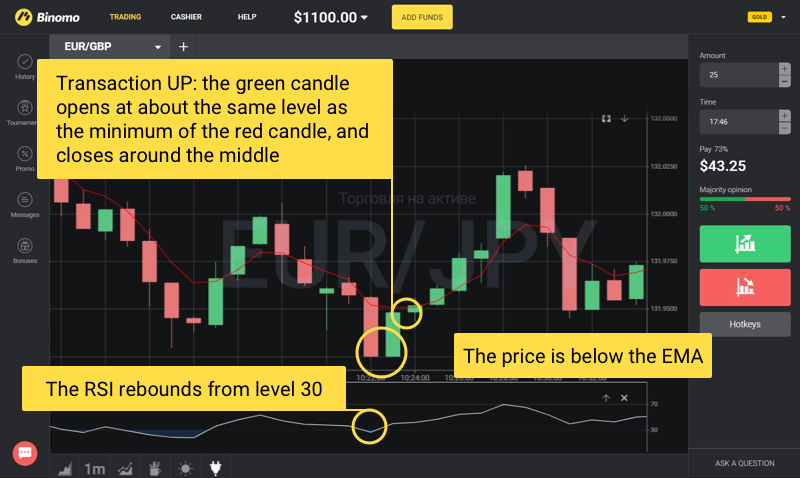

Conditions for transactions UP:

- The price is below the MA — a falling trend;

- The RSI touches level 30 or intersects it from the bottom upwards;

- A green candle appears after the red one. At the same time, the price of opening the green candle is below the red minimum (the end of the lower shadow of the red candle) or on the same level as it, and the price of closing the green candle does not cover the body of the previous red candle.

The candlestick pattern described above is called “A clearing in the clouds”, and it signals a reversal upwards. Here’s how it looks:

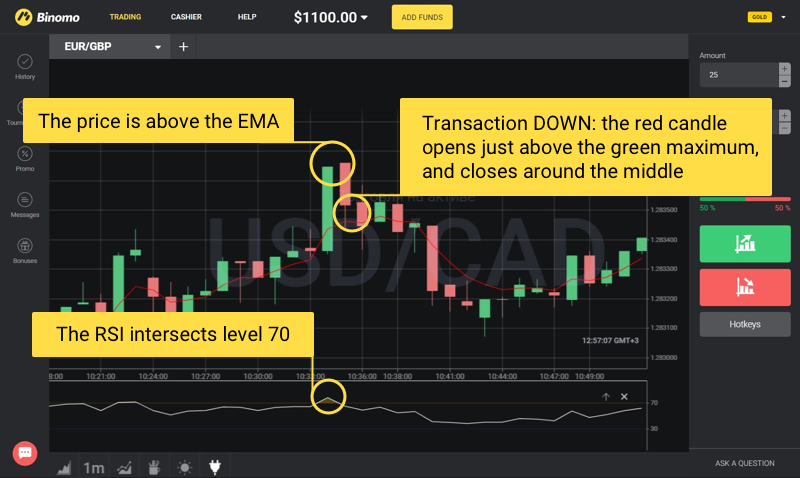

Conditions for transactions DOWN:

- The price is above the MA — a growing trend;

- The RSI touches level 70 or intersects it from the top downwards;

- A red candle appears after the green one. At the same time, the price of opening the red candle is above the green maximum (the end of the upper shadow of the green candle) or on the same level as it, and the price of closing the bearish candle does not cover the body of the bullish candle. It is often is at the middle level or slightly lower.

The candlestick pattern described above is called “A curtain of dark clouds”, and it signals a reversal downwards. Here’s how it looks:

Transactions are opened for periods of 3-7 minutes depending on the selected timeframe.

The strategy is suitable for any asset and time of day, but before trading it is worth making sure that no important macroeconomic news is expected at that time.